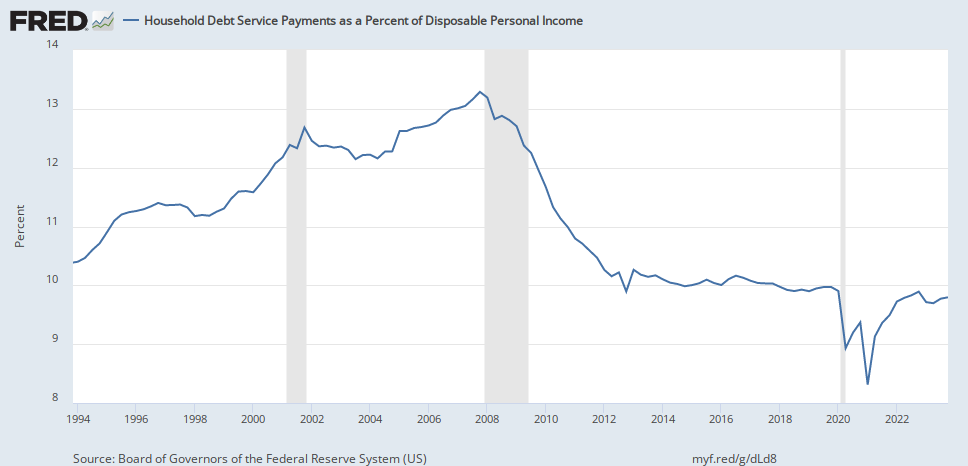

It is not an existential threat to households and the economy, Mr. Zandi said. It is an area where there is some stress.

The collapse of the credit bubble in 2008 was caused by:

- Failure of financial markets caused in-part by terribly leveraged banks

- Which drove collapse in hiring and wages

- Which drove defaults on lending

- Which drove runs on insurance

- Which left banks with no capital

- Which collapsed the economy

Of course this is the result of 10 years of easy lending. When the Fed makes money free, banks, businesses, and consumers take out more loans. Free or near-free money is what drove the US out of the recession, but this is the counter to that, poor consumer loan leverage. However, wages in the last two quarters have started catching up to very low unemployment, and the Fed rose rates 2 quarters ago, which increases savings and decreases easy money, which helps balance out leverage.