Fenderputty

Banned

The economy is largely lipstick on a pig, it was bound to happen at some point.

What?

What's happening?

The economy is largely lipstick on a pig, it was bound to happen at some point.

What is causing this?

This is mostly a response to whats going on in China, people believe its economy is slowing down.What is causing this?

This is mostly a response to whats going on in China, people believe its economy is slowing down.

More specifically, today there were some bad numbers (PMI is you want to get boringly technical) coming out of China.

Last summer the euro was going to collapse due a Greek exit and yet stocks rallied 25%+ after.

This is pretty much the right answer. the markets overreact to bad news, and there's a lot of it coming from china. Oil is also going down- partially due to oversupply, partially due to the iran deal going to add to that oversupply, and partially because china is not only slowing down, but all indications are that it's economic numbers are and have been fraudulent for a while.

While I agree the markets are overreacting (and more broadly, are pretty much divorced from the real economy) I would not generally recommend that people to try and catch a falling knife here.This is pretty much the right answer. the markets overreact to bad news, and there's a lot of it coming from china. Oil is also going down- partially due to oversupply, partially due to the iran deal going to add to that oversupply, and partially because china is not only slowing down, but all indications are that it's economic numbers are and have been fraudulent for a while.

Nothing to do with the US economy. You want to make a quick buck, start dumping money into the market before everyone comes to their senses in a week.

You want to make a quick buck, start dumping money into the market before everyone comes to their senses in a week.

If you're smart, an index fund.Into what?

Meanwhile the Canadian gas prices remain at $1.30 a litre here.

Isn't that almost $6 a gallon?

It allows a some people to make a lot of money without working, and they can use that money to affect policy.Never understood the psychological nonsense we've made of money and its fiction, and the fuck-bubble known as the stock market. The natural world couldn't care less.

And yet this nonsense produced a depression and a recession. We're really hijacked by stupidity, and that's scary.

If you're smart, an index fund.

It allows a some people to make a lot of money without working, and they can use that money to affect policy.

Then Wall Street tricked America into putting their retirement money there and now we all need to care if want to or not.

to be clear, a stock market can provide an important service to the real economy, and times it does, but these days, it's mostly bullshit.

It allows a some people to make a lot of money without working, and they can use that money to affect policy.

Then Wall Street tricked America into putting their retirement money there and now we all need to care if want to or not.

to be clear, a stock market can provide an important service to the real economy, and times it does, but these days, it's mostly bullshit.

Historically, the systems of trade that don't use fiat currency end up being even more inefficient than what we already have. It's the least worst solution.I was speaking more of the dogma that money is wealth, and all of the bullshit that comes with that poor line of thought.

It can provide good work in a system that uses it well as a tool, which it can be. Does America? LOL

Better keep shitting up the environment and continue global warming then so those people who are in the bussiness of shitting up the planet can keep getting their piece of the pie.

Looks like it's another sea of red in Asia at the moment, with US equity futures getting slammed. We could have a fun week ahead of us. Call me crazy but the Fed may be postponing an interest rate hike for a bit. Should we start taking bets on when QE4 is announced? =p

Edit: Wow, Shanghai Composite down over 8% right now even after the authorities said they were going to allow the state pension fund to invest in the stock market.

Unemployment rate is extremely low, aren't most economic indicators signaling that we've recovered well? There shouldn't be a need for QE4 and they should be able to raise interest rates correct?

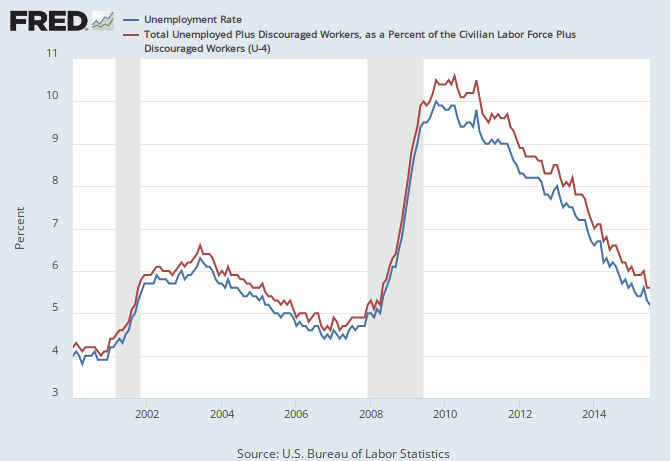

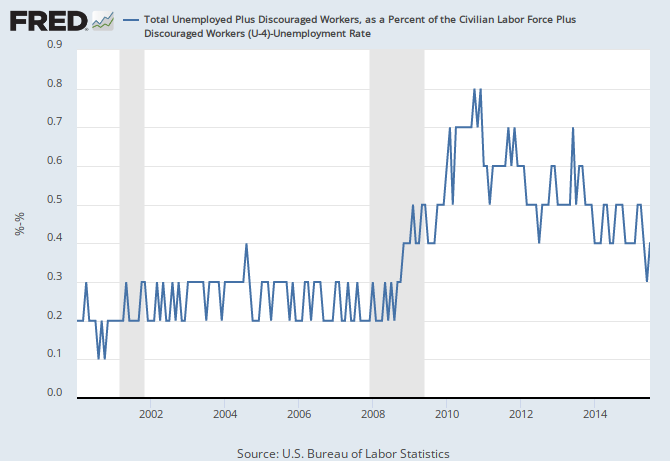

Unemployment rates are fun with numbers. A big contributor to it being so low is because a sizable number of people have given up on looking for work so aren't factored into the equation.

not that easy in the real world

Unemployment rates are fun with numbers. A big contributor to it being so low is because a sizable number of people have given up on looking for work so aren't factored into the equation.