GhostTrick

Banned

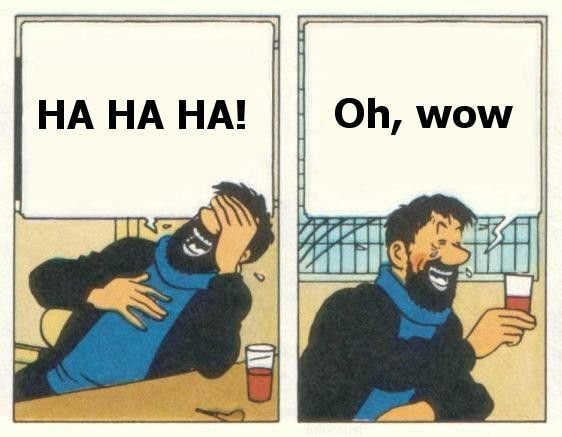

Why is Yves so scared of this takeover? I assume vivendi wants Ubisoft so they can keep making games and money. What's the problem?

Because Yves is French and knows how Vivendi's Vincent Boloré turns everything he touches into dust. Canal+ got fucked up and lost all its audience when it's been bought by Boloré. Ubisoft is likely to follow.