It's an easier argument to make by using very conservative estimates. Of course the real problem is much much worse.

And of course people will say 'sacrifices are needed. Move to a smaller house. Move further.' the point this falls apart is that, prices are universally high and this ignores that housing prices are often linked to access to jobs. That is to say by moving to cheaper housing also hurts the money you use to pay for said house.

That operates under the assumption that the ratio of wages to property value is exactly 1:1.

So can we talk about assumptions for a second? Assumptions of profitability and subsequent bubble were what led to the .com bust. Assumptions of increased property values mitigating the absurdly high risk of subprime loans were what led to the '08 market crash. The list goes on and on.

Now with that out of the way, let's break that cycle. The housing market profusely sucks right now. There's no two ways about that and while you'll see gradual shifts in some areas and anecdotes all over the place, it's pretty much a given that the market is at the very least turbulent. With me so far? Good.

Making critical decisions, things like having a budget, being wise about credit, thinking outside the box, dispelling myths like the 20% down, pursuing as many options as possible isn't for today. It's for tomorrow or the next day when the market corrects itself (as is inevitable despite the fallacy of what goes up will continue to and what goes down will continue as well that cost so many investors to this day). You want to be in the best possible spot to pounce when things shift (whether personally, professionally, financially, etc) into your favor.

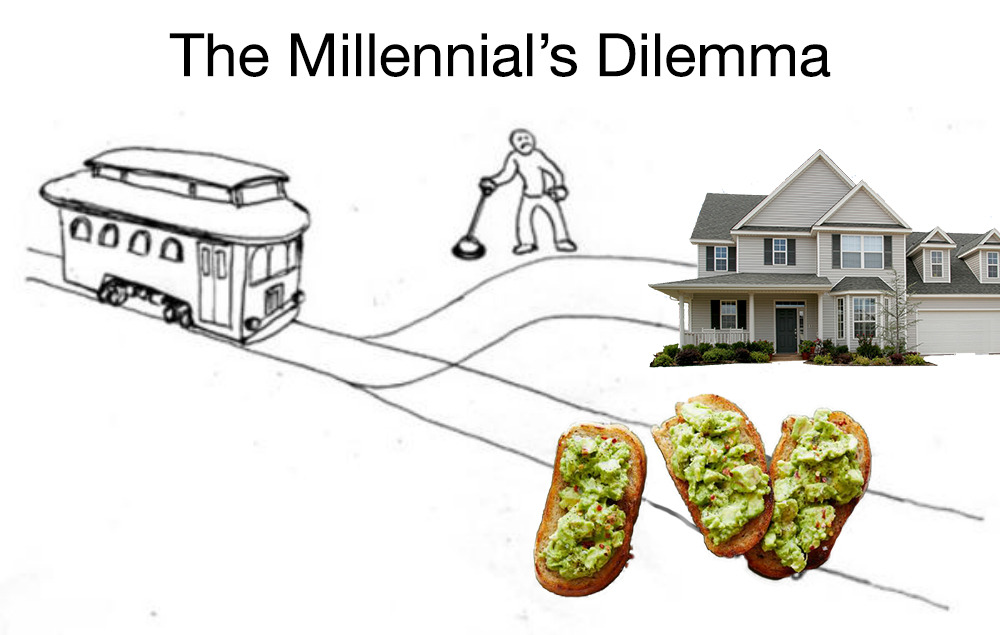

Saying "oh this will never happen so why try" is a recipe for disaster. I'm not saying don't have your avocado toast. Go for it. Enjoy it. Buy some video games. Go travel. But know at the same time how that plays both into your current budget and future flexibility.

The beauty of that old tweet from Wint is that there's actually a decent metaphor in there.