-

Hey, guest user. Hope you're enjoying NeoGAF! Have you considered registering for an account? Come join us and add your take to the daily discourse.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Australians may face 10% tax on Steam transactions

- Thread starter Maximo

- Start date

What is stopping you leaving?I seriously cannot wait to leave Australia.

Everytime I hear news about this country, it's always bad

What is stopping you leaving?

didn't you hear? they stopped the boats

Silentium

Member

Why shouldn't an entity selling intangibles into Australia have to collect GST on purchases? Not collecting the GST on these purchases is giving foreign sellers (like Steam) a cost advantage over Australian based sellers and is a significant tax leakage (I've seen some estimates of approx $2B p/a). This isn't unprecedented either, Europe has VAT collection for these purchases, and Australia already has GST reverse charging provisions for a similar reason.

What is stopping you leaving?

Currently getting my university degree, and after that I'll need to save up quite a fair bit

You can't just up and leave as you please. It's an expensive process that requires a lot of planning. Immigration alone is a massive pain in the ass

Where do you plan on going?Currently getting my university degree, and after that I'll need to save up quite a fair bit

You can't just up and leave as you please. It's an expensive process that requires a lot of planning. Immigration alone is a massive pain in the ass

Silentium

Member

The second.Can someone explain to me, is this on top of the normal sales tax or is this just applying the already-in place sales tax to digital goods? The way people seem outraged by it I'd say the first, but I have a suspicion it's the second.

It's the latter.Can someone explain to me, is this on top of the normal sales tax or is this just applying the already-in place sales tax to digital goods? The way people seem outraged by it I'd say the first, but I have a suspicion it's the second.

Where do you plan on going?

Depending on what happens between now and the time I've saved up enough money, either the US or Canada. I'm also pretty sure that this isn't the first time you've asked me about this in a thread.

Regardless, this is getting a bit off-topic. Australia's not doing too hot lately, and it hasn't for the past couple of years. I honestly and truly hope it manages to get better, but the current political climate doesn't fill me with much hope. It's quite disappointing

Cookie Dough

Member

Sorry guys but I don't see why digital video games shouldn't be taxed. This isn't some unjust outrage, it's a logical action for the government to take and it is inevitable.

I want my games as cheap as possible like anyone but I'm not going to pretend that my video games should be tax free when other things aren't.

I want my games as cheap as possible like anyone but I'm not going to pretend that my video games should be tax free when other things aren't.

Saintguine

Member

I thought one of the only good things about wingnuts is that they cut taxes.

And also, it's funny that the prime minister wonders why piracy is so rampant in Australia and then continue to pull this shit.

And also, it's funny that the prime minister wonders why piracy is so rampant in Australia and then continue to pull this shit.

Silentium

Member

How?This is a stupid decision and wil firth stagnate digital markets from ever truly taking off in Australia.

Why would collecting the broad, standard sales tax stagnate consumption of digital markets? Europe is now collecting VAT on these purchases, Japan has introduced similar legislation and Canada/NZ are considering similar changes to their own GST/VAT laws.

I'm pretty sure there is.Is there GST on PSN purchases? The emails I get never quite specify if it is included.

Because we already pay a ridiculous price when it comes to online goods because "Australia" and adding GST on top is going to push people further away.How?

Why would collecting the broad, standard sales tax stagnate consumption of digital markets? Europe is now collecting VAT on these purchases, Japan has introduced similar legislation and Canada/NZ are considering similar changes to their own GST/VAT laws.

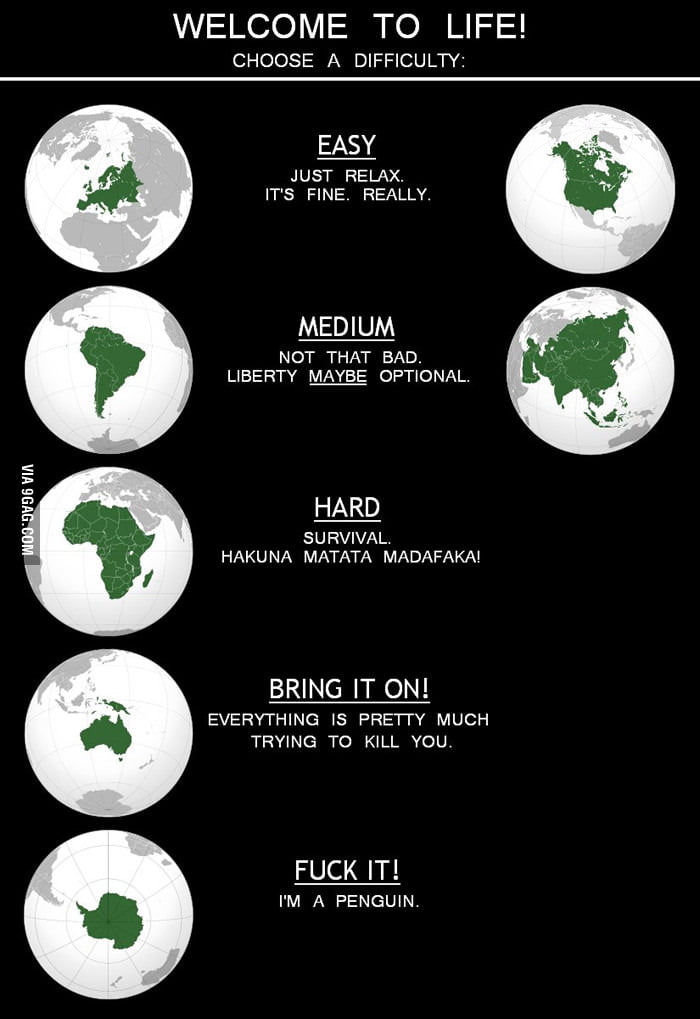

My heart goes out to AusGAF.

You guys got all those scary-ass killer animals, and y'all have to pay these crazy-ass prices for games..

Why is it that Australia seems to draw the shortest straw all the time?

Silentium

Member

The markup applied to Australian purchases is a separate issue. The issue here is that these entities are currently able to avoid the collection of GST because they sell from overseas - Australian based digital sellers already have to collect GST. As already stated, Australia isn't doing anything different from any other country by moving to collect sales tax on these purchases - they represent a significant tax loss for Australia (approx $2B I've seen estimated).Because we already pay a ridiculous price when it comes to online goods because "Australia" and adding GST on top is going to push people further away.

LiquidSolid

Member

Australia is already being "Marked Up"

Yeah, both Aus and NZ suffer heavily from the "fuck you" publisher tax. If GST is introduced on digital games, it SHOULD take its cut out of that but they probably won't, not when publishers have an easy excuse to just raise the prices higher.

Thanks. Bit of a relief.I'm pretty sure there is.

30yearsofhurt

Member

Why shouldn't an entity selling intangibles into Australia have to collect GST on purchases? Not collecting the GST on these purchases is giving foreign sellers (like Steam) a cost advantage over Australian based sellers and is a significant tax leakage (I've seen some estimates of approx $2B p/a). This isn't unprecedented either, Europe has VAT collection for these purchases, and Australia already has GST reverse charging provisions for a similar reason.

Noone's saying they shouldn't pay it but how do you make an overseas company pay tax in a country they don't even have a real presence in.

Sales taxes just are not capable of dealing with cross border transactions.

Eshop, psn and live already charge gst I'm pretty sure.^^^^ deadly fauna is a made up convention used to help slow the flow of foreigners . It's not really working anymore though.

....

So the eShop is going to be get more expensive? Fuck.

Understandable and I'm all for collecting on companies avoiding taxes, however the Australian pricing issue is still relevant. Even wih local representatives of a global company the markup is prevalent, meaning the tax would increase the price to even more ridiculous costings.The markup applied to Australian purchases is a separate issue. The issue here is that these entities are currently able to avoid the collection of GST because they sell from overseas - Australian based digital sellers already have to collect GST. As already stated, Australia isn't doing anything different from any other country by moving to collect sales tax on these purchases - they represent a significant tax loss for Australia (approx $2B I've seen estimated).

Silentium

Member

That's just not accurate. The point of GST/VAT etc is that the they're collected by the selling entity, not the government. We're not even talking about a significant cost burden, the EU estimate cross border VAT compliance at 5,000 euro per differing regime. And if entities don't comply? There are well established international legal avenues for recourseNoone's saying they shouldn't pay it but how do you make an overseas company pay tax in a country they don't even have a real presence in.

Sales taxes just are not capable of dealing with cross border transactions.

EDIT: I have to go out for a bit but I will be back later, I'll respond to peeps

EDIT2: Responded.

Elaugaufein

Member

The markup applied to Australian purchases is a separate issue. The issue here is that these entities are currently able to avoid the collection of GST because they sell from overseas - Australian based digital sellers already have to collect GST. As already stated, Australia isn't doing anything different from any other country by moving to collect sales tax on these purchases - they represent a significant tax loss for Australia (approx $2B I've seen estimated).

The problem with this is that the cost of collection results in a loss on the vast majority of purchases. There was a similar argument on GST for imported goods and the cutoff for profit was something like it only being worthwhile on shipments over ~$500.

The actual reason for blanket GST collection is protectionism/cronyism, ie it artificially increases the competitiveness of Australian companies (the truly sad thing is that in terms of digital goods we already suffer markup levels that mean even this isn't going to make them actually competitive).

Strange Young Man

Neo Member

Why shouldn't an entity selling intangibles into Australia have to collect GST on purchases? Not collecting the GST on these purchases is giving foreign sellers (like Steam) a cost advantage over Australian based sellers and is a significant tax leakage (I've seen some estimates of approx $2B p/a). This isn't unprecedented either, Europe has VAT collection for these purchases, and Australia already has GST reverse charging provisions for a similar reason.

I have heard analysis previously that indicated it would be near impossible to enforce and the cost of doing so would offset any extra revenue generated by the government.

My issue is that as a consumer this government is hell bent on gauging every last cent out of the vulnerable masses while ignoring, or in many cases subsidising, the outrageous profits extorted by those at the top of the pyramid.

Sutton Dagger

Member

It's an absolute farce that Valve are still charging in USD on the Australian store, plus the increased prices in general, Steam is fast becoming a terrible place to purchase games.

30yearsofhurt

Member

That's just not accurate. The point of GST/VAT etc is that the they're collected by the selling entity, not the government. We're not even talking about a significant cost burden, the EU estimate cross border VAT compliance at 5,000 euro per differing regime. And if entities don't comply? There are well established international legal avenues for recourse

EDIT: I have to go out for a bit but I will be back later, I'll respond to peeps

You're missing the point.

The Australian government cannot enforce our tax laws on non-residents.

That's our law.

I haven't purchased a game directly on Steam for some time now. No point when I can get it cheaper through other legitimate avenues.It's an absolute farce that Valve are still charging in USD on the Australian store, plus the increased prices in general, Steam is fast becoming a terrible place to purchase games.

Yeah I'm the same. I can't remember last time I actually used steam to buy anything.I haven't purchased a game directly on Steam for some time now. No point when I can get it cheaper through other legitimate avenues.

The $2b figure is pulled out of someones ass and is not even remotely realistic. There's no way in hell there's $20bn in untaxed imports of intangibles per year. That would equate to 22m people spending $900/year. Each. What a load of horseshit. I'll start listening to arguments for this when realistic numbers are presented.The markup applied to Australian purchases is a separate issue. The issue here is that these entities are currently able to avoid the collection of GST because they sell from overseas - Australian based digital sellers already have to collect GST. As already stated, Australia isn't doing anything different from any other country by moving to collect sales tax on these purchases - they represent a significant tax loss for Australia (approx $2B I've seen estimated).

TheVampire

Banned

Cool, so now its;

- game priced at Australian RRP

- charged in US currency so + exchange rate difference

- +10% on top for GST.

Good one. Thank fuck for GMG and sales.

It really is bullshit

Sorry guys but I don't see why digital video games shouldn't be taxed. This isn't some unjust outrage, it's a logical action for the government to take and it is inevitable.

I want my games as cheap as possible like anyone but I'm not going to pretend that my video games should be tax free when other things aren't.

It wouldn't sting as much if games here weren't already significantly more expensive than they are in many other countries.

CrankyKong

Member

I haven't bought a game directly from steam in years because of the pricing.

This will only make things worse.

This will only make things worse.

Cannon Goose

Member

$89.99 USD for a digital PC game was too cheap anyway, I'm happy with this change.

FUCK THIS

Pretty sure you are already paying GST on PSN.Well it was fun while it lasted I guess... If this bleeds over to PSN I'm going to be really pissed off. We already pay a premium there.

I can't see why Steam should be exempt.

Do they have an Australian presence? No they don't. They don't charge in AUD either. That proves to me they're a foreign entity. A foreign entity is under no obligation to collect tax for the Australian government for a transaction that takes place outside of Australia. That's all it comes down to in the end.Pretty sure you are already paying GST on PSN.

I can't see why Steam should be exempt.

Well the alternative is admitting that the LNP passed tax legislation that reduced the competitiveness of Australian businesses and that's never going to happen. Anyway as I said, if we're going to have a GST I'm not going to get upset that it's being applied fairly.The actual reason for blanket GST collection is protectionism/cronyism, ie it artificially increases the competitiveness of Australian companies (the truly sad thing is that in terms of digital goods we already suffer markup levels that mean even this isn't going to make them actually competitive).

Pretty sure you are already paying GST on PSN.

I can't see why Steam should be exempt.

We are definitely paying something that's for sure.

30yearsofhurt

Member

Do they have an Australian presence? No they don't. They don't charge in AUD either. That proves to me they're a foreign entity. A foreign entity is under no obligation to collect tax for the Australian government for a transaction that takes place outside of Australia. That's all it comes down to in the end.

This is it right here.

Sony, Microsoft and Nintendo maintain local operations because they need to market and supply physical goods. Maintaining the e-stores is a side effect of that.

Steam and Netflix don't. There's no one to tax within the Australian government's jurisdiction.

Have a look at the biggest investors in Australia by country. Cayman Islands is right up there with China. Why? Because we can't stop Australian companies selling stuff to themselves overseas.

This proposed tax is a stupid idea thought up by the stupidest treasurer we've had in history.