Earthstrike

Member

Good. About fucking time non-progressive taxation had some pushback.

Give everyone a flat 15% income tax across the board.

It's just all talk unless he actually does something. He's just trying to get the liberal wing motivated so they vote Democrat in the next election cycle. They still won't do anything though.

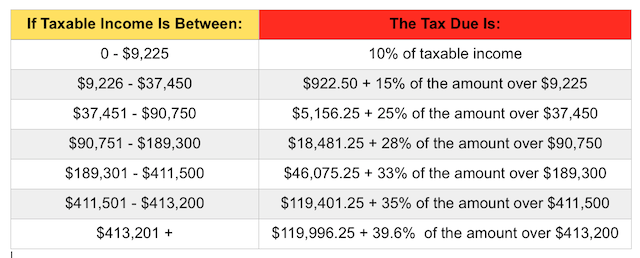

This man gets it.The tax system is structured in such a way that the income that you need to survive as a human being is taxed disproportionately high (income taxes stacked on sales taxes). The marginal utility of the money in the higher tax brackets is smaller because you already have your basic needs taken care of (food, shelter, childcare, etc) with plenty left over. As a result, the wealthy typically end up investing that money rather than spending it.

Losing $5k with a $35k income is going to hurt more than losing $120k when you're making $420k. They're taking the ramen right out of people's mouths. If the idea is to stimulate the economy through an increase in consumer spending then that money needs to go to the middle class. But the real boot on the throat of middle class America is student debt.

Yup

Dude was basically a repub with dems in power

What a joke

Obama finally starts throwing out some ideas after losing both houses of congress so nothing he says can ever become law. Too bad he didn't think of this stuff when his party had complete control of the government...

And Obama knows it. He's pandering with empty promises.

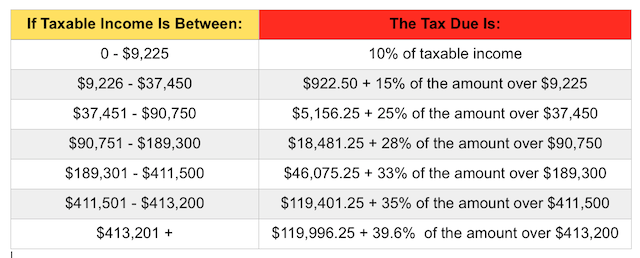

How about both. Personally I'd like to see less military spending, higher taxes on the rich, and no fucking tax cuts for anyone.23.8 to 28 is a steep jump, jeez. How about lessen up that military spending?

There is no need to raise taxes without offsets (raising taxes on one demo, and lowering them for another). The deficit is going down, and is one-again within sustainable levels (we actually want to have a deficit to a certain extent). What is increasing is income inequality- which is what this policy is meant to deal with,How about both. Personally I'd like to see less military spending, higher taxes on the rich, and no fucking tax cuts for anyone.

This is the worse idea ever.Give everyone a flat 15% income tax across the board.

This is the worse idea ever.

A flat tax looks good on paper but it's nothing but a regressive tax structure. Not every dollar is worth the same to everyone else.

The tax system is structured in such a way that the income that you need to survive as a human being is taxed disproportionately high (income taxes stacked on sales taxes). The marginal utility of the money in the higher tax brackets is smaller because you already have your basic needs taken care of (food, shelter, childcare, etc) with plenty left over. As a result, the wealthy typically end up investing that money rather than spending it.

Losing $5k with a $35k income is going to hurt more than losing $120k when you're making $420k. They're taking the ramen right out of people's mouths. If the idea is to stimulate the economy through an increase in consumer spending then that money needs to go to the middle class. But the real boot on the throat of middle class America is student debt.

I wish our health care was cheaper. My premium at work just went up from $400 a month to $850 for a family.

yeah my premiums increase pretty much ate up my annual raise. Sick of how expensive healthcare is.

Anyways, thanks Obama, for bringing us all these great ideas when the party of lunatics has control of both houses of congress.

Meanwhile, the amount of tax breaks at the top is utterly ridiculous. No one making $400k+ is paying a 40% income tax rate. Their ETR is frequently in the twenties, and some people get down into the single digits.

They can't do anything. Every Republican in Congress signs Grover Norquist's pledge that they will NEVER EVER raise taxes under any circumstances. No matter how much our infrastructure crumbles or a natural disaster wipes out entire states, or we need to spend trillions funding wars, Republicans will never vote for more tax revenue.

And Obama knows it. He's pandering with empty promises.

Which makes the Democratic majority in the first two hears even more disheartening.

But I agree, he's stealthily campaigning for Hillary in advance.

Bill that was passed was more or less what repubs wanted in first place, though they argued for sureThis man gets it.

A laughable assertion. A Republican would not have proposed a healthcare bill of any kind, and probably would have tried to attack Social Security, or something.

Ugh. Daycare is not the option this country should move toward. Let people be with their children.

23.8 to 28 is a steep jump, jeez. How about lessen up that military spending?

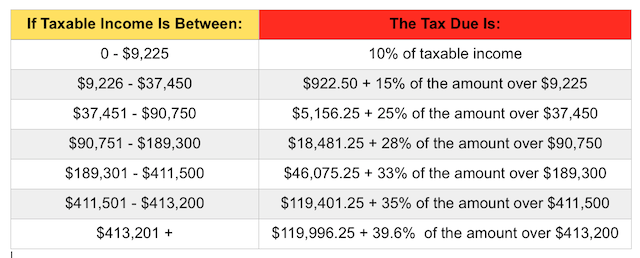

I don't think I can actually get behind the idea of tax cuts for the middle class. The American middle class is one of the wealthiest groups of people in the world. Why not instead raise taxes on the wealthy and the middle class in order to lower taxes/help out the poor?

Of course I also think that taxing both corporations and capital gains/dividends is silly and that corporate taxes should be eliminated, so obviously I'm a pretty shitty socialist. The corporate tax is a pretty ineffective tax anyway.

Obama finally starts throwing out some ideas after losing both houses of congress so nothing he says can ever become law. Too bad he didn't think of this stuff when his party had complete control of the government...

Define "complete". The dude had 2 years of Democratic majority. What more do you want?His party never had complete control of the government and the fact you'd assert this means you're better off reading this thread than "contributing" to it. Not being mean. Not insulting you. Just read about Republican obstructionism and learn something.

Define "complete". The dude had 2 years of Democratic majority. What more do you want?

Not insulting you, but you seem insatiable.

Romney did, though.This man gets it.

A laughable assertion. A Republican would not have proposed a healthcare bill of any kind, and probably would have tried to attack Social Security, or something.

This is the same logic as trickle down economics. I'm in favor of direct spending instead, as I mentioned

I mean sure, you cut middle class taxes so people can go blow their refunds at Walmart and stimulate the gdp and finance some minimum wage jobs while funneling most that money back to the rich. Is it good for the economy? Probably, but I don't think its good for the country

The tax system is structured in such a way that the income that you need to survive as a human being is taxed disproportionately high (income taxes stacked on sales taxes). The marginal utility of the money in the higher tax brackets is smaller because you already have your basic needs taken care of (food, shelter, childcare, etc) with plenty left over. As a result, the wealthy typically end up investing that money rather than spending it.

Losing $5k with a $35k income is going to hurt more than losing $120k when you're making $420k. They're taking the ramen right out of people's mouths. If the idea is to stimulate the economy through an increase in consumer spending then that money needs to go to the middle class. But the real boot on the throat of middle class America is student debt.

Jesus Christ demon. Has anyone outside of FDR had that kind of majority? I'm no history buff but I'm guessing he did.There was never a true filibuster-proof super majority in the Senate. That would have been "complete control of the government".

daycare is awesome, i learned the alphabet there.

I wish our health care was cheaper. My premium at work just went up from $400 a month to $850 for a family.

That would require them to win.Republicans are just gonna undo everything after the next election.

Jesus Christ demon. Has anyone outside of FDR had that kind of majority? I'm no history buff but I'm guessing he did.

There was the ACA, a lot of blood sweat in tears went into it and Republicans have been fighting it with everything they have to this very day.

It's not a promise, he's suggesting it as an idea.

So he should just sit back quietly while the lunatics run the asylum?Nothing more than lip service.

The Republicans are all about those tax cuts. Lets see if they don't backflip on that long held stance now

The presidents plan would raise $320 billion over the next decade, while adding new provisions cutting taxes by $175 billion over the same period.

Obama finally starts throwing out some ideas after losing both houses of congress so nothing he says can ever become law. Too bad he didn't think of this stuff when his party had complete control of the government...

America has a middle class?

.He is proposing it, but his proposal will go nowhere.