Maiden Voyage

Gold™ Member

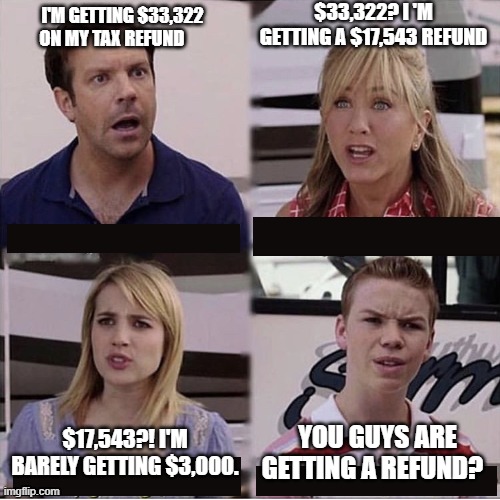

It's tax season--everyone's favorite winter activity!

I started my filing this morning and have W2 & deductions/exemptions entered. Somehow, some way it looks like I don't have to pay in this year. In fact, I'm getting a nice refund. Typically, I pay in so this is a pleasant surprise. My wife & I both received some stimulus money, which I expected to work against us. I still need to wait for my 8889 forms for post-tax HSA contributions before I can officially file, but everything else is locked in.

Is anyone else seeing a much more favorable return this year?

I started my filing this morning and have W2 & deductions/exemptions entered. Somehow, some way it looks like I don't have to pay in this year. In fact, I'm getting a nice refund. Typically, I pay in so this is a pleasant surprise. My wife & I both received some stimulus money, which I expected to work against us. I still need to wait for my 8889 forms for post-tax HSA contributions before I can officially file, but everything else is locked in.

Is anyone else seeing a much more favorable return this year?