-

Hey, guest user. Hope you're enjoying NeoGAF! Have you considered registering for an account? Come join us and add your take to the daily discourse.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock-Age: Stocks, Options and Dividends oh my!

- Thread starter koam

- Start date

Troblin said:I have no idea what your trading in, but GJ on the +3900% gain

hah.. oh no, no.

I didn't profit on those. I'm just pointing them out cause I think options are something worth learning about. Actually, I'm not suggesting anyone get into options anytime soon.

The biggest reason I brought these up is so people can see the craziness of an options Expiration day and the games money managers play to manipulate the market on these days. I still think the market ends the day flat.. a 200 point (1.5%) round trip on the DOW in one day is crazy.

I'm just trying to lead you guys to the water. I had to learn about all this stuff on my own with little to no help from anyone.. and while I'm not going to hold anyone's hand I'll bring to light specific things I think are worth learning and answer any questions for those who do ant to learn more. I'd love nothing more than for everyone in this thread to become astute investors and gain financial independence. If you want something bad enough anything is possible.

sonarrat said:I don't think the housing market has bottomed, no. It's still in the early stages. But all the things you are talking about are public knowledge, and they're all depressing the share prices already.

That's true and I applaud that thinking but I think those things are going to seriously hinder their ability to do business going forward. That's just my opinion though.

I said coming in here I didn't want to make suggestions to people and that's what I did.

My apologies.

koam said:oil up = up, cost of living = up, products cost more, people buy less, stocks fall.

That's the "logic" behind it.

If that's the case, I'm guessing it's time to cash out, and put the money in the good old 5% return CDs, or some high Dividend paying stocks.

I understand that, but it's just one day. People collectively react too wildly by one day's news.... "Oil up... well time for suicide, the world is over".koam said:oil up = up, cost of living = up, products cost more, people buy less, stocks fall.

That's the "logic" behind it.

lil smoke said:I understand that, but it's just one day. People collectively react too wildly by one day's news.... "Oil up... well time for suicide, the world is over".

Pretty much. Today is a good "BUY" day.

Yeah, everyone buy cheap today, and everyone SELL it next month on the day oil goes up. EVERYONE! DO IT! :lolkoam said:Pretty much. Today is a good "BUY" day.

Maybe a real estate fund would be safer at this point than just dumping it all into CFC. They have so many bad loans that they could just blow apart like a broken flywheel, who knows.

I'm happy with my slow-but-steady approach so far, 6.2% return on a mutual fund in 2 months is pretty tame but it beats the money market pretty soundly. I paid an even $3,000 and earned $187, including a dividend that was reinvested into the fund.

I'm happy with my slow-but-steady approach so far, 6.2% return on a mutual fund in 2 months is pretty tame but it beats the money market pretty soundly. I paid an even $3,000 and earned $187, including a dividend that was reinvested into the fund.

Trading Curbs are in.

http://en.wikipedia.org/wiki/Trading_curb

http://en.wikipedia.org/wiki/Trading_curb

A trading curb, also known as a circuit breaker, is a point at which a stock market will stop trading for a period of time in response to substantial drops in value.

Maxwell House

Member

Stocks are doing awesome today. :lol

These are the days I wish I had a time machine.

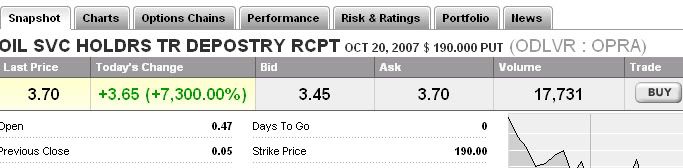

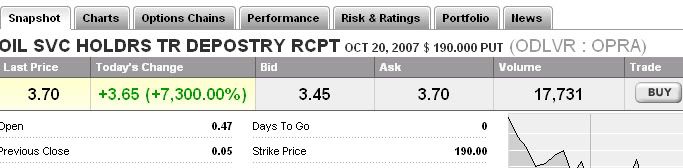

For every $100 you would have invested yesterday you'd have $7300 today.

For every $100 you would have invested yesterday you'd have $7300 today.

I had about 5k worth of sept. puts. I they were Oct 190's I'd be opening my studio on Monday.

I bought them for a whole lot more of course.. but again, that's why you I need that time machine. I would have saved that 5k (and a Whole lot more) and put it on that..

I bought them for a whole lot more of course.. but again, that's why you I need that time machine. I would have saved that 5k (and a Whole lot more) and put it on that..

Holy shit... that was a fucking nice rise =P.

I was thinking of investing in some IPOs, some companies sound interesting, like BioHeart, though I've read they are having some nasty problems, they seem to have potential. Check this: http://www.ipohome.com/common/ipoprofile.asp?ticker=BHRT .

Recommendations? I wanna invest in cheap ass stocks that could have GIANT potential in the future.

I was thinking of investing in some IPOs, some companies sound interesting, like BioHeart, though I've read they are having some nasty problems, they seem to have potential. Check this: http://www.ipohome.com/common/ipoprofile.asp?ticker=BHRT .

Recommendations? I wanna invest in cheap ass stocks that could have GIANT potential in the future.

Looks like the Bears finally got their payback for the Fed screwing them over the last two months on OpEx. Good for them, I'm just sad I'm not there to celebrate with them.

That's okay.. I have my Forex account to keep me company.

Speaking of.. there's a global economic conference going on right now and through the weekend called G7. The comments made here usually affect currencies in a drastic manner. A lot of today might just be in preparation for any negative reports about the dollar.. such as the Fed plans to lower rates further and that inflation is not a concern. Obviously a positive report would probably signal a rally on Monday, which I think is the most likely scenario.

The dollar is hitting new lows almost daily as it is. That would only further it along and force China and Japan to liquidate more of our money. Whatever the case. I'm looking for a strong Euro coming out of this weekend.. and seeing as the chairmen on that side of the pond are straight shooters and talk a tough stance on inflation and have talked about raising rates to curb it. I think I'll be just fine.

That's okay.. I have my Forex account to keep me company.

Speaking of.. there's a global economic conference going on right now and through the weekend called G7. The comments made here usually affect currencies in a drastic manner. A lot of today might just be in preparation for any negative reports about the dollar.. such as the Fed plans to lower rates further and that inflation is not a concern. Obviously a positive report would probably signal a rally on Monday, which I think is the most likely scenario.

The dollar is hitting new lows almost daily as it is. That would only further it along and force China and Japan to liquidate more of our money. Whatever the case. I'm looking for a strong Euro coming out of this weekend.. and seeing as the chairmen on that side of the pond are straight shooters and talk a tough stance on inflation and have talked about raising rates to curb it. I think I'll be just fine.

koam said:Heh I don't think your stock has any of my conditions.

How come you bought a stock AFTER such a huge rise?

Sandisk beat expectations.. down 5 bux

1) The price. If their stock is under $10 I won't even consider them. check

2) Their charts. If a company is at the same spot as they were 6 months ago, no. I've they've been on a decline no. If they've been steady and risen dramatically in the past few days, no. Basically, I look for companies that are on the rise and are steady. check

3) What does this company do and do I know them? I study what they sell or the service they provide and see if there's lot of future potential. That's why I like stuff like LED/OLED and RFIDs. Ethanol is in high demand, corn might be a good stock then. A minerals company, and gold was strong lately

4) How are their earnings? Did they do well the last quarter? yes

too bad the market dropped, cause at the opening it was going very well as i expected. Anyways i lost only 60 cents on 1000$ + 4.95$ for the trade. I'm confident it's a good choice.

Pretty bad day overall. I unloaded my GOOG at 650 which looked to be a good idea short term at least.

My ISRG running up just offset everything else that went down today that I have. Oh well, at least I didn't lose anything.

AAPL earnings on Monday, who here is going to hold through? I am for sure.

My ISRG running up just offset everything else that went down today that I have. Oh well, at least I didn't lose anything.

AAPL earnings on Monday, who here is going to hold through? I am for sure.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Alright terrible day, anniversary of Black Monday too, but I'm holding on everything (even if I should get rid of IMMR). The investments are made, I made them knowing I could loose them, it won't affect my life I will wait for the indexes to reach their previous highs mentioned in a previous post, and it doesn't matter how long I have to wait.

I will wait for the indexes to reach their previous highs mentioned in a previous post, and it doesn't matter how long I have to wait.

Here are some of the results of the stocks on my watchlist:

First of all, once again Ubisoft is up, + 2,22%. They will release their earnings on October 23rd.

Halliburton is down 5.27%.

Exxon and Royal Dutch Shell both fell around 3% and 2% respectively.

Marvel down 7.45%. Earnings on Nov. 5

Nvidia down 5.37%

Orbital Sciences wasn't TOO affected by today's fall, down 1.50% "Defense firms look strong" article. But I don't see them going up until the market does, they might just fall less than other sectors. Raytheon was down 2.23% today.

Goog was up 0.80% today, down 0.27% in after hours.

APPL was down 1.78% and is up 0.52% in after hours.

RIMM down 1.83%, up 0.03% in after hours.

Sony was down 3.38% but is up 0.98% in after hours.

PANL was up 0.89% on no news (other than director selling shares yesterday )

)

ValueClick was up 4.09% and is up 0.85% in after hours, on no news. Earnings coming Nov. 1st.

My equities:

ATVI down 2.61%, IMMR down 7.15%, TTWO down only 0.27% and up 0.71% in after hours. CGT down 2.30%.

Again I repeat what I said before just because I think it is sound: buy low and sell high shouldn't mean buy when the share is low and sell when it is high, it means buy when the index is low (which really means when it is recovering because you can never tell when low is really low) and sell when the index is high (using the previous all-time high as an indicator). You can NEVER know when a share's low is the lowest. Halliburton is down 5.27% and I see articles about buying on this dip, but it's not a dip until the whole market says so, for all we know it could drop another 20%. Buy on market recovery (rise on the indexes that took a around three days, and buy only when it reaches around 30% of the previous all-time high) and sell once it reaches the previous all-time high. Makes sense to me, but don't invest in small businesses because all could go in flames between the moment you buy and the moment you sell, with no chance of a come back even if the market performs well (the mistake I might have made with IMMR).

Anyway I hope no one here has invested amounts they couldn't afford to lose. If I did I would sell, screw the loss, I prefer to keep some money and come back when I have stronger foundations so I can spend money I can afford to lose. Remember this is just a game

Here are some of the results of the stocks on my watchlist:

First of all, once again Ubisoft is up, + 2,22%. They will release their earnings on October 23rd.

Halliburton is down 5.27%.

Exxon and Royal Dutch Shell both fell around 3% and 2% respectively.

Marvel down 7.45%. Earnings on Nov. 5

Nvidia down 5.37%

Orbital Sciences wasn't TOO affected by today's fall, down 1.50% "Defense firms look strong" article. But I don't see them going up until the market does, they might just fall less than other sectors. Raytheon was down 2.23% today.

Goog was up 0.80% today, down 0.27% in after hours.

APPL was down 1.78% and is up 0.52% in after hours.

RIMM down 1.83%, up 0.03% in after hours.

Sony was down 3.38% but is up 0.98% in after hours.

PANL was up 0.89% on no news (other than director selling shares yesterday

ValueClick was up 4.09% and is up 0.85% in after hours, on no news. Earnings coming Nov. 1st.

My equities:

ATVI down 2.61%, IMMR down 7.15%, TTWO down only 0.27% and up 0.71% in after hours. CGT down 2.30%.

Again I repeat what I said before just because I think it is sound: buy low and sell high shouldn't mean buy when the share is low and sell when it is high, it means buy when the index is low (which really means when it is recovering because you can never tell when low is really low) and sell when the index is high (using the previous all-time high as an indicator). You can NEVER know when a share's low is the lowest. Halliburton is down 5.27% and I see articles about buying on this dip, but it's not a dip until the whole market says so, for all we know it could drop another 20%. Buy on market recovery (rise on the indexes that took a around three days, and buy only when it reaches around 30% of the previous all-time high) and sell once it reaches the previous all-time high. Makes sense to me, but don't invest in small businesses because all could go in flames between the moment you buy and the moment you sell, with no chance of a come back even if the market performs well (the mistake I might have made with IMMR).

Anyway I hope no one here has invested amounts they couldn't afford to lose. If I did I would sell, screw the loss, I prefer to keep some money and come back when I have stronger foundations so I can spend money I can afford to lose. Remember this is just a game

Ether_Snake said:Anyway I hope no one here has invested amounts they couldn't afford to lose. If I did I would sell, screw the loss, I prefer to keep some money and come back when I have stronger foundations so I can spend money I can afford to lose. Remember this is just a game

It'll go back up as always. It's just a matter of time. Look how far the index has gained since the .com bubble burst.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Javaman said:It'll go back up as always. It's just a matter of time. Look how far the index has gained since the .com bubble burst.

Yeah I know but I mean if someone invested money he can't afford to lose he better take what he can now, we don't know for how long the drop will last, or for how long we have to wait to make gains. If you can't pay the rent or if you end up in debt because of this it's not worth it

Ether_Snake said:Yeah I know but I mean if someone invested money he can't afford to lose he better take what he can now, we don't know for how long the drop will last, or for how long we have to wait to make gains. If you can't pay the rent or if you end up in debt because of this it's not worth it

Selling now would be an immediate and irrevocable loss while holding on for a while would almost definitely be a gain. If someone is investing into the stock-market with funds that they need to live day to day, they really need to get their priorities straight. Investing should always be a 5 year or longer plan.

Ether_Snake said:Again I repeat what I said before just because I think it is sound: buy low and sell high shouldn't mean buy when the share is low and sell when it is high, it means buy when the index is low (which really means when it is recovering because you can never tell when low is really low) and sell when the index is high (using the previous all-time high as an indicator). You can NEVER know when a share's low is the lowest. Halliburton is down 5.27% and I see articles about buying on this dip, but it's not a dip until the whole market says so, for all we know it could drop another 20%. Buy on market recovery (rise on the indexes that took a around three days, and buy only when it reaches around 30% of the previous all-time high) and sell once it reaches the previous all-time high. Makes sense to me, but don't invest in small businesses because all could go in flames between the moment you buy and the moment you sell, with no chance of a come back even if the market performs well (the mistake I might have made with IMMR).

Anyway I hope no one here has invested amounts they couldn't afford to lose. If I did I would sell, screw the loss, I prefer to keep some money and come back when I have stronger foundations so I can spend money I can afford to lose. Remember this is just a game

Seriously your tactic of timing the market just sounds awful. All it's going to result in is losing more money than had you just bought good stocks and forgetting about it. You either invest for long term or you better have much better short term trading tactics of just buying on market rebounds and selling on highs. At least mrWalrus gives some good advice without pushing any stocks. I would suggest you read up on technical analysis or some other decent books about trading.

I disagree with some of this. There really isn't a such thing as 'awful tactic' any more then there is a 'perfect tactic'. It all depends on circumstance, timing, common sense and most of all LUCK. Otherwise, we all would be rich by playing the market the exact same way. And, I don't think anyone's pushing any stocks.rage1973 said:Seriously your tactic of timing the market just sounds awful. All it's going to result in is losing more money than had you just bought good stocks and forgetting about it. You either invest for long term or you better have much better short term trading tactics of just buying on market rebounds and selling on highs. At least mrWalrus gives some good advice without pushing any stocks. I would suggest you read up on technical analysis or some other decent books about trading.

Forex

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

rage1973 said:Seriously your tactic of timing the market just sounds awful. All it's going to result in is losing more money than had you just bought good stocks and forgetting about it. You either invest for long term or you better have much better short term trading tactics of just buying on market rebounds and selling on highs. At least mrWalrus gives some good advice without pushing any stocks. I would suggest you read up on technical analysis or some other decent books about trading.

That's fine that you disagree with it. And I'm not pushing any stocks, I mention different results of stuff that is on my watchlist because I know we don't always remember to get check a bunch of stocks everyday, I thought it could be interesting.

Anyway here are some examples of how it works, you can judge for yourself and better yet go and do it for any stocks you want from proven companies.

BTW I matched the following all to the NASDAQ (shown in orange) just to be quicker, and forget the confusing text at the top, I overlayed two images in Photoshop:

GOOG: I usually check the chart and see if I applied the same tactic over the previous years would I have made a lot of gains, good gains? If not I wouldn't buy the stock. Here you can see there are a few losses, moreso than in the companies below, but the gains erase those losses, but barely. I probably wouldn't have invested in GOOG because of this.

NVDA: As you can see, there is one loss, and it is extremely minimal, completely erased by any other gains. Using this tactic + getting info about the company and its sector would, in my opinion, make me more apt at deciding whether or not to invest in them. In this case I would (this isn't pushing stock, I'm saying how I would use this tactic to evaluate, in part, potential investments).

HAL: I circled a gray-area. The NASDAQ was at 2460 on the marked highest of highs, and then reached 2457, which was close enough to me to make it a sell, but seriously, if I didn't put a sell there I would have had a big loss once it would have reached 2460 again. Of course no one has to sell in the red

RTN: Once again, you can see two losses, which are extremely minimal and completely wiped out by the numerous gains. If I had applied the same logic as with HAL, the first loss would have actually been a gain (selling when the NASDAQ reaches 2457 even if the previous one was 2460. I put a sell here just to show you again that it's not perfect, I could have made a gain if I acted like with HAL, but it's always possible that other factors would make me think twice, in this case leading to a small loss. But again, all losses are then erased).

INTC: Gains only

I tried with RIMM and noticed it wasn't following any indexes adequately over more than around the last 6 months, they were up at the wrong times, etc., causing lots of losses, so I wouldn't have bought from it if I applied this tactic because I wouldn't buy shares if its value hasn't been following the NASDAQ/DOW/S&P over a good period of time.

So that's it, I think in the end it enables me to minimize risks. I miss the lowest of lows and highest of highs, but I also increase my chances of making gains by making sure the stocks are more or less in line with the indexes and reduce the size of my losses when they occur. My gains are not as high as they could be, but since I can never tell when a gain is at its highest I think the above tactic is safer. You guys can judge this for yourself, try it for fun and just mix a stock with an index in PS and see for yourself. I'm not pushing this in anyone's throat, just explaining this and I like everyone's advices here

Maxwell House

Member

Many stocks don't really track with the indices that closely, and some seem to go in the opposite direction. You might want to check out the betas of stocks to see their correlation to the market.Ether_Snake said:Again I repeat what I said before just because I think it is sound: buy low and sell high shouldn't mean buy when the share is low and sell when it is high, it means buy when the index is low (which really means when it is recovering because you can never tell when low is really low) and sell when the index is high (using the previous all-time high as an indicator). You can NEVER know when a share's low is the lowest. Halliburton is down 5.27% and I see articles about buying on this dip, but it's not a dip until the whole market says so, for all we know it could drop another 20%. Buy on market recovery (rise on the indexes that took a around three days, and buy only when it reaches around 30% of the previous all-time high) and sell once it reaches the previous all-time high. Makes sense to me, but don't invest in small businesses because all could go in flames between the moment you buy and the moment you sell, with no chance of a come back even if the market performs well (the mistake I might have made with IMMR).

I am a big fan of small companies.

And one of the many anomalies in the efficient market hypothesis is the small company one. Historically, small cap stocks consistently outperform the market. Some theorize it is because of an extra risk premium for small cap volatility, which makes sense.

Maxwell House said:Many stocks don't really track with the indices that closely, and some seem to go in the opposite direction. You might want to check out the betas of stocks to see their correlation to the market.

I am a big fan of small companies.They have much more upside potential than larger caps, IMO. Buffet said he could make 50% gains every year if he had the flexibility to invest in small cap stocks (but he can't..he has too much money). I am invested 80-85% in small caps right now and my portfolio is doing very well (even though it is an odd year for small caps..they are actually doing worse than the Dow in 2007 thus far).

And one of the many anomalies in the efficient market hypothesis is the small company one. Historically, small cap stocks consistently outperform the market. Some theorize it is because of an extra risk premium for small cap volatility, which makes sense.

I'm investing in a lot of emerging market small CAPs as well. However, I'm a little worried with the market as of late. Small CAPs tend to be a lot more volatile than their mid/large CAP counterparts.

For instance on Friday, I had drops ranging as high as 11%. The stock that had a P/E and forward P/E of 10 and 8 respectively, so valuation was NOT the issue.

I'm afraid that if the economy heads towards a major recession, small CAPs will take a large hit regardless of their valuation/ growth prospects.

What are your thoughts?

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Maxwell: Yeah well to me it's just a question of minimizing risks. If I was a better investor I could change my position. I'm still new. Plus as for companies that don't follow the indexes, that's why I verify if they have been following them for some time.

Troblin: I see it this way:

Imagine if there are numerous ships and boats on the sea. The sea levels changes constantly, which makes the boat rise or descend along with it. But in between the sea level changes, waves are what causes boats and ships to rise and descent, and not all as one. Two ships/boats on the same sea are not affected by the same waves, but they are all affected by the sea level tho.

Big ships have more predictable motions because only the large waves affect them fully, while small boats have erratic motions caused by waves both great and small, which makes their motion more difficult to predict.

If the ships and boats increase speed, it reduces our ability to predict their motions because they end up encountering waves of different sizes at a more rapid pace; it gives us less time to notice the changes and make predictions.

Big ships can afford to increase speed because they are still only affected by large waves, and even at high speed it is still easier to predict its motion than compared to small boats, altho more difficult than if they went at lower speed. And there is always the risk of flipping over, no ships are invincible

Small boats can take the risk to increase speed, but they are affected by both large and small waves, and you can image the potential gains and risks it implies: they could hit a wave they can't handle and end up flipping upside down, or they could manage to ride the waves and sometimes even literally "leap into the air" (imagine a jetski driver, he may leap into the air but it's then all about landing properly, if he doesn't he's going to plunged straight into the water, slow his advance as a result, and maybe be completely halted).

Big ships have more difficulty avoiding icebergs because they can only take slow measures to avoid collisions, while small boats can usually avoid them with greater ease, altering their trajectories at a quicker pace, but in both cases it's only if they are aware of the presence of the icebergs to begin with, and usually big ships are better equipped to know of this in advance, but a small boat which had knowledge of the presence of icebergs can take a whole different trajectory to begin with

Troblin: I see it this way:

Imagine if there are numerous ships and boats on the sea. The sea levels changes constantly, which makes the boat rise or descend along with it. But in between the sea level changes, waves are what causes boats and ships to rise and descent, and not all as one. Two ships/boats on the same sea are not affected by the same waves, but they are all affected by the sea level tho.

Big ships have more predictable motions because only the large waves affect them fully, while small boats have erratic motions caused by waves both great and small, which makes their motion more difficult to predict.

If the ships and boats increase speed, it reduces our ability to predict their motions because they end up encountering waves of different sizes at a more rapid pace; it gives us less time to notice the changes and make predictions.

Big ships can afford to increase speed because they are still only affected by large waves, and even at high speed it is still easier to predict its motion than compared to small boats, altho more difficult than if they went at lower speed. And there is always the risk of flipping over, no ships are invincible

Small boats can take the risk to increase speed, but they are affected by both large and small waves, and you can image the potential gains and risks it implies: they could hit a wave they can't handle and end up flipping upside down, or they could manage to ride the waves and sometimes even literally "leap into the air" (imagine a jetski driver, he may leap into the air but it's then all about landing properly, if he doesn't he's going to plunged straight into the water, slow his advance as a result, and maybe be completely halted).

Big ships have more difficulty avoiding icebergs because they can only take slow measures to avoid collisions, while small boats can usually avoid them with greater ease, altering their trajectories at a quicker pace, but in both cases it's only if they are aware of the presence of the icebergs to begin with, and usually big ships are better equipped to know of this in advance, but a small boat which had knowledge of the presence of icebergs can take a whole different trajectory to begin with

ComputerNerd

Banned

I've transformed myself into a buy and holder. I'm long term now.

I mostly use a stock picking service. They pick small caps that are undervalued, and poised for great returns over X number of years.

I only sell if company fundamentals change that I didn't foresee in my original analysis, and i don't like where the company is headed.

I mostly use a stock picking service. They pick small caps that are undervalued, and poised for great returns over X number of years.

I only sell if company fundamentals change that I didn't foresee in my original analysis, and i don't like where the company is headed.

Maxwell House

Member

Yeah, that is the scary thing about small caps..they are extremely volatile.Troblin said:I'm investing in a lot of emerging market small CAPs as well. However, I'm a little worried with the market as of late. Small CAPs tend to be a lot more volatile than their mid/large CAP counterparts.

For instance on Friday, I had drops ranging as high as 11%. The stock that had a P/E and forward P/E of 10 and 8 respectively, so valuation was NOT the issue.

I'm afraid that if the economy heads towards a major recession, small CAPs will take a large hit regardless of their valuation/ growth prospects.

What are your thoughts?

Historically, small caps do worse than mid and large caps during bear markets but outperform them handily during bull markets. They have very high betas, which means that when the market does bad, they do even worse, and when the market does well, they do even better. Their swings are greater.

As long as you have a long term outlook, and are patient, and not trigger happy, small caps are a nice way to invest. You just have to stop yourself from selling when the market goes bad, because you will miss out on the recovery, where small caps really take off.

Basically, if you trade small caps, you have to be patient enough to wait out the bear markets and bad months. If you can do that, you will be rewarded when things pick back up.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Tomorrow will probably be another ugly day tho. I see no reasons for the situation to change. All big wars started with small-scale sudden incidents no one was paying attention to, this time it could be the Turkey/Kurds front. It disrupts everyone's plans, forcing one to make his move before its due date and leading his opposition to seize this opportunity in a now-or-never rush.

Hopefully this issue will be resolved quickly.

Hopefully this issue will be resolved quickly.

Maxwell House

Member

Yeah, tomorrow (heck, the rest of October) could be pretty damn ugly. We will see.

I need to find some more money so that I can buy more stocks on sale if the market continues to bleed this week.

I need to find some more money so that I can buy more stocks on sale if the market continues to bleed this week.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

But how will you know when it has bled enough to make your buy worth it?

I think we're all better off waiting for a clear recovery before throwing more money, what's the rush?

I think we're all better off waiting for a clear recovery before throwing more money, what's the rush?

yeah, i would never buy on a drop. Thats way too rissky.

The ideal moment to buy for me is on a buy signal. when a stock just pass a resistence with a good volume.

edit: i just saw some news and i predict amzn will go up 7-8% tomorrow. Wish i had convert some of my cad money in usd before. I would have place a limit order at 91$x 10 shares for tomorrows oppening.

The ideal moment to buy for me is on a buy signal. when a stock just pass a resistence with a good volume.

edit: i just saw some news and i predict amzn will go up 7-8% tomorrow. Wish i had convert some of my cad money in usd before. I would have place a limit order at 91$x 10 shares for tomorrows oppening.

Maxwell House said:Yeah, that is the scary thing about small caps..they are extremely volatile.

Historically, small caps do worse than mid and large caps during bear markets but outperform them handily during bull markets. They have very high betas, which means that when the market does bad, they do even worse, and when the market does well, they do even better. Their swings are greater.

As long as you have a long term outlook, and are patient, and not trigger happy, small caps are a nice way to invest. You just have to stop yourself from selling when the market goes bad, because you will miss out on the recovery, where small caps really take off.

Basically, if you trade small caps, you have to be patient enough to wait out the bear markets and bad months. If you can do that, you will be rewarded when things pick back up.

Yeah. It's pretty rare that I reshuffle my 401k mutual funds around, but this small cap volatility pushed me into it. Even worse, I think a couple of stocks in the fund were tied into construction and loan brokers. It weathered the .com pop fairly well, but I'm going to ride out the trouble with 40% in mid caps and a 20/20/20 split between small cap, international, and techs.

Maxwell House

Member

I have specific price targets for a list of 8-10 stocks I am following. If there is a dip, I am sure a few of them will get to my target buy price.Ether_Snake said:But how will you know when it has bled enough to make your buy worth it?

I think we're all better off waiting for a clear recovery before throwing more money, what's the rush?

The tricky part is having the funds available to buy them.

Maxwell House

Member

???_Rafa_ said:your strategy seems very risky.

How is it risky? I find companies I like based on their fundamentals and find a target price by looking at their forward intrinsic value along with other ratios. If the market dips and they get into my price range, I buy. As long as I like the company, I am fine with buying them. Market dips are temporary, and I invest for the long term.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Doesn't seem like it will be a good day either. I think it will take a few months for the markets to recover from the August drop (which is still affecting us now obviously).

Maxwell House said:???

How is it risky? I find companies I like based on their fundamentals and find a target price by looking at their forward intrinsic value along with other ratios. If the market dips and they get into my price range, I buy. As long as I like the company, I am fine with buying them. Market dips are temporary, and I invest for the long term.

thats seems better now. Example?

_Rafa_ said:edit: i just saw some news and i predict amzn will go up 7-8% tomorrow. Wish i had convert some of my cad money in usd before. I would have place a limit order at 91$x 10 shares for tomorrows oppening.

What news? It's down 0.5% before open.

Maxwell House

Member

Sure._Rafa_ said:thats seems better now. Example?

Here are five companies I am following and the buy target I'd like to get in at:

1. BABY - 14.80

2. GG - 29.50

3. MRH - 16.52

4. MIDD - 61.30

5. SNHY - 28.60

I like all 4 companies because they have good, consistent growth rates, are in good positions in their markets, have good management and are trading low compared to their forward intrinsic values. GG is a gold play (a sector I like for the next 5 years or so).

The market does look horrible, and I believe it is possible we are already in the very beginning days of a recession (as Caterpillar said last week).

Today is going to be bleeding red it seems.