R

Rösti

Unconfirmed Member

SUNNYVALE, CA -- (Marketwired) -- 04/21/16 -- AMD (NASDAQ: AMD) today announced revenue for the first quarter of 2016 of $832 million, operating loss of $68 million, and net loss of $109 million, or $0.14 per share. Non-GAAP(1) operating loss was $55 million and non-GAAP(1) net loss was $96 million, or $0.12 per share.

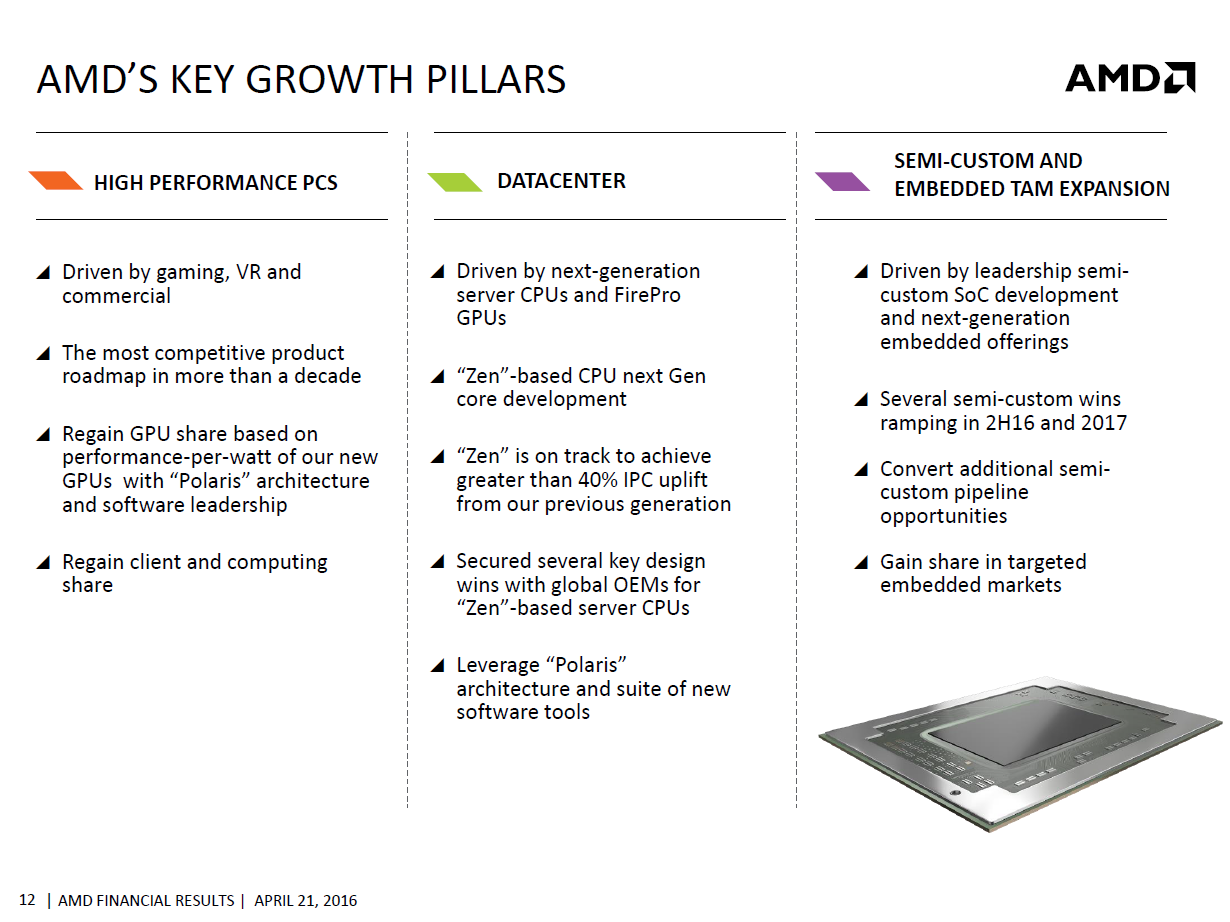

"Our strategy to build a strong business foundation and improve financial performance through delivering great products is beginning to show benefits," said Lisa Su, AMD president and CEO. "We continued to strengthen the performance of our Computing and Graphics business as our customers and partners show a growing preference for AMD. We are optimistic about our growth prospects in the second half of the year across our businesses based on new product introductions and design wins."

Q1 2016 Results

- Q1 2016 was a 13-week fiscal quarter.

- Revenue of $832 million, down 13 percent sequentially and down 19 percent year-over-year. The sequential decrease was primarily due to lower sales of semi-custom SoCs. The year-over-year decline was primarily due to lower sales of semi-custom SoCs and client notebook processors.

- Gross margin of 32 percent, up 2 percentage points sequentially, due primarily to a richer product mix and the mix of revenue between business segments.

- Operating expenses of $344 million, compared to $332 million for the prior quarter. Non-GAAP operating expenses of $332 million, compared to non-GAAP operating expenses of $323 million in Q4 2015, primarily due to increased R&D expenses related to new products, partially offset by lower SG&A expenses.

- Operating loss of $68 million, compared to an operating loss of $49 million for the prior quarter. Non-GAAP(1) operating loss of $55 million, compared to non-GAAP(1) operating loss of $39 million in Q4 2015, primarily due to lower sales.

- Net loss of $109 million, loss per share of $0.14, and non-GAAP(1) net loss of $96 million, non-GAAP(1) loss per share of $0.12, compared to a net loss of $102 million, loss per share of $0.13 and non-GAAP(1) net loss of $79 million, non-GAAP(1) loss per share of $0.10 in Q4 2015.

- Cash and cash equivalents were $716 million at the end of the quarter, down $69 million from the end of the prior quarter, due to lower sales and higher debt interest payments, partially offset by $52 million of cash received related to our newly announced IP licensing agreement.

- Total debt at the end of the quarter was $2.24 billion, flat from the prior quarter.

Financial Segment Summary

- Computing and Graphics segment revenue of $460 million decreased 2 percent sequentially and decreased 14 percent from Q1 2015. The sequential decrease was primarily due to decreased sales of client desktop processors and the year-over-year decrease was driven primarily by decreased sales of client notebook processors.

- Operating loss was $70 million, compared with an operating loss of $99 million in Q4 2015 and an operating loss of $75 million in Q1 2015. The sequential improvement was primarily driven by lower operating expenses. The year-over-year improvement was primarily driven by lower operating expenses.

- Client processor average selling price (ASP) decreased sequentially driven by a lower desktop processor ASP and decreased year-over-year primarily due to a lower notebook processor ASP.

- GPU ASP decreased sequentially driven by lower consumer GPU ASPs and increased year-over-year due to higher channel and professional graphics ASPs.

- Enterprise, Embedded and Semi-Custom segment revenue of $372 million decreased 24 percent sequentially and 25 percent year-over-year. The decreases were primarily driven by lower sales of semi-custom SoCs.

- Operating income was $16 million compared with $59 million in Q4 2015 and $45 million in Q1 2015. The sequential and year-over-year decrease was primarily due to lower sales and higher R&D expenses associated with new product investments, partially offset by a $7 million IP licensing gain.

- All Other category operating loss was $14 million compared with operating losses of $9 million in Q4 2015 and $107 million in Q1 2015. The year-over-year decrease was primarily due to the absence of restructuring and other special charges associated with the exit from the dense server systems business.

Source: http://ir.amd.com/phoenix.zhtml?c=74093&p=irol-newsArticle&ID=2159398

http://edge.media-server.com/m/p/me7hjshq/lan/enAMD will webcast its earnings conference call on Thursday, April 21, 2016 at 5:00 p.m. EDT / 2:00 p.m. PDT to discuss the results of its fiscal first quarter ended March 26, 2016. All interested parties will have the opportunity to listen to the real-time audio webcast of the teleconference over the Internet through AMD's website at ir.amd.com. An archive of the webcast will be available for approximately one year after the conference call.

I'm gonna tune in to the conference call mainly to hear if they will share some info on new consoles (NX, PS4K etc.). There will be a transcript of the call posted x hours after the call has ended.

Presentation slides

http://phx.corporate-ir.net/Externa...yfFBhcmVudElEPTUyMjMwODZ8Q2hpbGRJRD02MzAyNTQ=