Trojita

Rapid Response Threadmaker

https://www.wsj.com/articles/fed-to...nt-unusual-disruptions-in-markets-11584033537

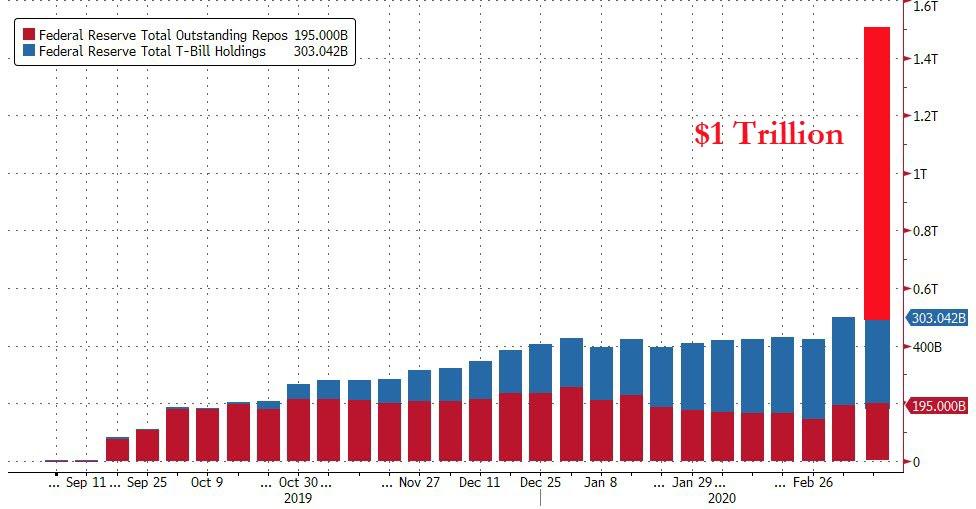

$ 1, 5 0 0 , 0 0 0 , 0 0 0 , 0 0 0 . 0 0

The Federal Reserve said it would inject more than $1.5 trillion of temporary liquidity into Wall Street on Thursday and Friday to prevent ominous trading conditions from creating a sharper economic contraction.

“These changes are being made to address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak,” the New York Fed said in a statement on Thursday

The Fed said it had made the changes for short-term funding markets following instructions from Chairman Jerome Powell, who was in consultation with the rate-setting Federal Open Market Committee.

A deepening rout on Wall Street has fueled strains on financial-market plumbing, putting pressure on the central bank to intervene in a way not seen since the 2008 financial crisis.

“Financial markets are not functioning well, and the liquidity situation is evolving into something that necessitates a broader and stronger response by the Federal Reserve,” said Brian Sack, who ran the New York Fed’s markets desk from 2009 to 2012 and is now the director of economics at hedge-fund manager D.E. Shaw group.

The moves suggest the Fed is shifting toward implementing the type of long-term asset purchases it deployed during and after the 2008 financial crisis, first to restore market functioning and later to spur a faster recovery in employment and output

$ 1, 5 0 0 , 0 0 0 , 0 0 0 , 0 0 0 . 0 0

Last edited: